Cobrar pagos de manera eficiente es esencial para el negocio de WordPress de cada freelancer. Si bien PayPal ha sido una opción popular durante años, viene con limitaciones, incluidas restricciones de país y es posible que no todos tus clientes quieran usarlo.

Creemos que Stripe se destaca como la mejor opción para la mayoría de los freelancers, ofreciendo tarifas más bajas, mayor facilidad de uso y una experiencia de pago más profesional. Su integración perfecta con WordPress hace que aceptar pagos sea sencillo y seguro.

Pero no estás limitado solo a estas dos opciones. Ya sea que necesites diferentes métodos de pago, menores costos de transacción o un mejor soporte internacional, existen alternativas confiables.

En este artículo, compartiremos algunas de las mejores alternativas a PayPal para que los freelancers cobren pagos en WordPress.

¿Por qué buscar alternativas a PayPal para aceptar pagos en línea?

PayPal ha hecho que las transacciones en línea sean rápidas y sencillas. Permitiendo a los propietarios de sitios de WordPress ganar dinero en línea vendiendo productos y servicios.

Sin embargo, existen ciertos problemas con PayPal que llevan a muchos usuarios a buscar alternativas a PayPal.

Por ejemplo, hay varios países en desarrollo donde PayPal no funciona. Y herramientas populares para freelancers se pueden comprar con PayPal, lo que crea un obstáculo para los usuarios.

Además, los cargos por transacción de PayPal también son elevados y pueden acumularse significativamente con el tiempo.

Quizás la razón más grande por la que la gente busca alternativas a PayPal es su comportamiento incierto.

Además, muchas cuentas de PayPal han sido bloqueadas o suspendidas por problemas menores, lo que ha causado grandes pérdidas a varios usuarios de PayPal.

Ahora, para ayudarte, hemos encontrado los mejores servicios de pago que puedes usar como alternativas a PayPal en tu sitio de WordPress.

1. Stripe

Stripe se ha convertido rápidamente en la alternativa a PayPal más popular y una de las pasarelas de pago más populares. Desafortunadamente, solo está disponible en unos pocos países seleccionados.

La mejor parte de usar Stripe son las tarifas más bajas, la facilidad de uso y la integración perfecta en populares plataformas de comercio electrónico de WordPress como WooCommerce y Shopify.

Si no quieres configurar una tienda en línea completa, puedes crear un formulario simple con WPForms para cobrar pagos a través de Stripe de tus clientes.

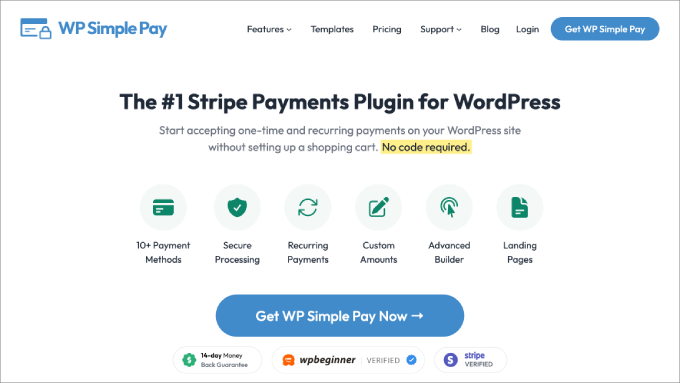

Y si quieres una solución aún más sencilla, entonces deberías instalar el plugin WP Simple Pay en tu sitio de WordPress.

WP Simple Pay es el plugin de pagos de Stripe para WordPress más popular. Te permite cobrar pagos en línea únicos y recurrentes de tus usuarios sin añadir un carrito de compras ni páginas de productos dedicadas.

Además, WP Simple Pay viene con plantillas de formularios de pago listas para usar y un constructor de formularios personalizado para que adaptes tus formularios de pago.

Esto facilita todo para los principiantes que desean aceptar pagos con Stripe.

Las tarifas de Stripe varían según el país en el que te encuentres. Para los Estados Unidos, tienen una tarifa fija del 2.9% + 30¢ por cada cargo exitoso de tarjeta de crédito.

También tenemos una reseña detallada de Stripe vs. PayPal que puedes consultar para obtener más información.

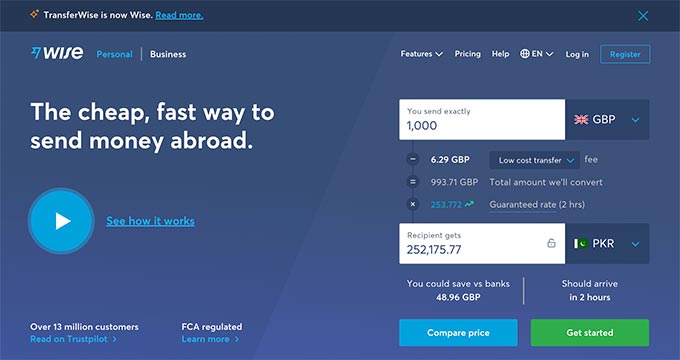

2. Wise

Wise (anteriormente conocido como Transferwise) permite a tus clientes pagarte directamente en tu moneda local. Se les cobrará el pago y se enviará a tu cuenta bancaria como una transferencia local.

Está disponible en muchos países y monedas. Las tarifas de Wise varían según la ubicación tanto del remitente como del receptor.

Sin embargo, hemos descubierto que a menudo es mucho más bajo que otros servicios de pago o una transferencia bancaria directa. También utilizan el mismo tipo de cambio que ves en Google o XE, lo que también te ahorra dinero adicional en el cambio de divisas.

Una desventaja es que Wise no permite que los pagos comerciales se envíen en algunos países.

Por lo tanto, te recomendamos que te asegures de consultar la página del país antes de solicitar a tus clientes que te envíen dinero para conocer los precios y el estado de los pagos comerciales.

3. Bitcoin

Las criptomonedas están de moda hoy en día. Bitcoin es una de las primeras y más conocidas criptomonedas del mundo.

También permite a los usuarios enviar y recibir dinero a través de fronteras sin necesidad de un intermediario como un banco o un operador de transferencia de dinero que se lleva una parte de la transacción.

Si tu cliente está familiarizado con Bitcoin, entonces puede transferirte dinero fácilmente a tu billetera de Bitcoin.

Luego puedes convertir esta cantidad a moneda local a través de un exchange de Bitcoin, usar la cantidad en línea o transferirla a cualquier otro servicio de pago.

Coinbase, una plataforma de trading de bitcoin, permite a las empresas aceptar pagos en bitcoin. Ya está siendo utilizada por empresas importantes como Expedia, Dell, Intuit, Wikimedia Foundation y más.

4. Payoneer

Payoneer es un nombre confiable en la industria de pagos en línea. Está disponible en muchos países alrededor del mundo.

Actualmente no hay integraciones disponibles para conectarlo directamente a tu comercio electrónico o sitio web de membresía. Sin embargo, puedes solicitar a los clientes que envíen pagos a través de Payoneer.

Payoneer también hace que sea bastante conveniente retirar pagos a tu cuenta bancaria local o usar una tarjeta de débito de marca Payoneer para retirar pagos de cajeros automáticos en cualquier parte del mundo.

La desventaja es que sus comisiones son más altas en comparación con Stripe o PayPal, pero más bajas que las de otros proveedores de servicios de pago.

Por aceptar pagos con tarjeta de crédito directamente de los clientes, se te cobrará el 3% del monto de la transacción. Adicionalmente, se te cobrarán $1.50 por una transferencia bancaria local en la misma divisa. Si retiras el monto a una cuenta en otra divisa, pagarás un 2% adicional del monto de la transacción.

5. QuickBooks

QuickBooks es uno de los mejores programas de contabilidad para freelancers y profesionales. Te permite enviar facturas fácilmente a tus clientes y aceptar pagos directamente en tu cuenta bancaria.

Tus clientes pueden hacer clic en el botón de pago en cualquier momento y realizar pagos usando sus tarjetas de crédito.

QuickBooks es un software de contabilidad, por lo que puedes conectarlo a tus tarjetas de crédito, cuenta bancaria y PayPal para registrar todas tus transacciones.

QuickBooks es una solución de pago por uso. Las tarifas por un pago facturado son del 2.9% + 25¢ en cada transacción. Si cobras más de $7,500 al mes, puedes contactarlos para obtener una tarifa con descuento.

6. Verifone

Verifone, anteriormente conocido como 2Checkout, es una de las pasarelas de pago más conocidas y una buena alternativa a PayPal. Todos los plugins populares de comercio electrónico para WordPress tienen complementos para integrar Verifone como tu pasarela de pago.

También puedes agregarlo a tu tienda en línea y comenzar a vender productos a países donde Stripe o PayPal no son compatibles.

Verifone ofrece diferentes métodos de retiro de pagos, e incluso puedes integrar tu tarjeta de débito Payoneer para retirar pagos.

Otras características notables incluyen pagos recurrentes, experiencia de pago alojada, múltiples monedas y soporte de idiomas.

Los cargos de Verifone varían según el país en el que te encuentres. Para los Estados Unidos, se te cobrará el 2.9% del monto de la transacción + 30¢ en cada transacción.

7. Google Wallet

Google Wallet es otra excelente opción para reemplazar PayPal para tus pagos. Actualmente solo está disponible en los Estados Unidos y el Reino Unido, y no puedes enviar pagos de EE. UU. al Reino Unido.

No tiene una integración lista para usar disponible para ninguna plataforma de comercio electrónico de WordPress.

Al igual que muchas otras herramientas y servicios de Google, no cobra ninguna tarifa por enviar o recibir dinero.

Esto lo convierte en una gran opción para los freelancers que desean solicitar pagos de clientes a través de Google Wallet.

Esperamos que este artículo te haya ayudado a encontrar las mejores alternativas a PayPal para cobrar pagos en WordPress. También te puede interesar nuestra guía definitiva sobre el procesamiento de pagos en WordPress para principiantes, y nuestras selecciones expertas de los mejores plugins de Square para WordPress.

Si te gustó este artículo, suscríbete a nuestro canal de YouTube para obtener tutoriales en video de WordPress. También puedes encontrarnos en Twitter y Facebook.

Jiří Vaněk

Gracias por los consejos. Actualmente solo uso Paypal en el sitio. Sin embargo, después de leer algunos de tus artículos, me interesó mucho la posibilidad de usar Stripe. No se usa mucho aquí en la República Checa, pero sin duda será una buena opción para los lectores extranjeros. Gracias por los artículos en los que abordas este tema. Me ayudaron a decidir.

Soporte de WPBeginner

¡Nos alegra que nuestras recomendaciones hayan sido útiles!

Administrador

ahmed

Hola,

¿Quickbooks funciona con algún país o hay alguna restricción?

Gracias

Soporte de WPBeginner

A menos que sepamos lo contrario, no tiene una limitación de país, pero querrás consultar con Quickbooks para obtener la información más actualizada sobre cualquier limitación.

Administrador

Ramesh Gupta

Es un blog genial con información maravillosa.

Soporte de WPBeginner

Thank you

Administrador

alex

¿Hay algún plugin para TransferWise como PayPal, Stripe, etc.? Es decir, ¿cómo se puede ofrecer una forma fácil para que los clientes paguen productos en una tienda en línea con TransferWise?

evan

¡Parece que TransferWise fue eliminado como plugin y ya no está disponible!

Rahul Rawat

Es un blog genial con información maravillosa... ¡¡¡¡¡¡sigue así!!!!!!

Kingsley

Stripe, Payza, Google Wallet son inútiles para países en desarrollo, al igual que PayPal

Jay

¿Alguien tiene el plugin de Payoneer para WordPress?

Giorgos

Payoneer no usa pasarelas de pago a través de plugins. Tienes que enviar notificaciones de pago por correo electrónico a tu cliente, yo también lo uso. Una vez hablé con ellos y les pregunté sobre un plugin, pero me dijeron que no estaba en sus planes. Pero quizás en el futuro.

Bilguun

¿Puedo usar estas alternativas a eBay y Shopify? Disculpa, quiero aclararlo.

Bell

El SEO nunca ha tenido un hogar adecuado, porque es técnico, es más adecuado para personas que han aprendido la industria y tienen experiencia, esto puede ser bastante raro con los SEOs. Publicado esto en Twitter, muy útil

Subhrajit

El problema que enfrento con Payoneer es que no proporcionan el botón de pago ahora en la factura para los indios.

Daniel

Esto podría ser un poco complicado, pero estoy considerando la opción de usar el plugin WooCommerce para WordPress. Y luego elegir entre otros proveedores de procesamiento de pagos, como Stripe o Cardinity. ¿Crees que podría funcionar para cobrar pagos en WordPress o un plugin directo cobra menos por los pagos?

jay

Hola... ¿qué modo de pago en línea es mejor para mí? Ya que voy a hacer un trabajo en línea por primera vez y por favor infórmame cuál es el más confiable y cobra menos. Soy de Mumbai. Gracias.

leona zoya

Después de dos años de usar Payoneer, y de tener transacciones regulares y decentes, Payoneer bloqueó mi cuenta hace dos meses, sin ninguna explicación ni motivo. Cada intento que he hecho para averiguar qué ha pasado, en el chat en vivo, terminó sin éxito, con la explicación de que se pondrían en contacto conmigo por correo. En 2 meses no he recibido ningún correo electrónico de ellos, y los he contactado por chat en vivo unas 10 veces. La última vez que los contacté, me desconectaron antes de que tuviera la oportunidad de preguntarles qué estaba pasando. Todavía tengo 200 dólares en mi cuenta, que no puedo retirar. Incluso podría haber sido más.

Quiero aprovechar esta oportunidad para advertir a todas las personas en el mundo que se mantengan alejadas de Payoneer, y a todos los que la usan actualmente, que se detengan, porque aparentemente pueden bloquear tu tarjeta sin ninguna razón o explicación, ¡¡¡tal como me lo hicieron a mí!!!

Watt

Suena a lo que me hizo Paypal.

Cuanto más crecen, menos les importan sus clientes.

Al final, solo tendré que darle mi número de cuenta a mis clientes para que me envíen el dinero directamente.

James

¡Exactamente lo que me hizo PayPal! Recomendaría a todos los comerciantes en línea serios que se mantengan alejados de las pasarelas de pago gratuitas como Paypal y Payoneer

Andrew Essiet

Payoneer solo bloquea una cuenta donde hay transacciones sospechosas. Puedes ir a tu página y desbloquearla. No son como PayPal en ningún nivel. Solo hacen lo que hacen para proteger tu cuenta de ser manipulada ilegalmente.

Giorgos

Hola

He estado usando Payoneer por mucho tiempo. Nunca tuve un problema. Pero, las últimas veces que envié una notificación por correo electrónico para un pago, siempre me preguntan si es un pago comercial o privado. Quizás quieren aclarar el registro de negocios en una cuenta comercial. ¡Solo una opinión mía!

Arafat

Buena lectura, gracias. Paypal es un gran método de pago para freelancers. Por muchas razones, es posible que necesites una opción de pago diferente a PayPal. Payoneer puede ser una buena alternativa a PayPal para recibir fondos de mercados de freelancers. Disfruté Moneybookers en 2011, pero (ahora) Skrill ha cambiado su política, por lo que las personas de nuestro país enfrentan dificultades con esto. Si tuviera que elegir los 3 principales métodos de pago para freelancers, seleccionaría PayPal, Payoneer y Skrill. Puedes leer mi publicación al respecto:

Laura Key

Buena información… Pero PayPal todavía domina el mundo de los freelancers

Gustavo

Hola. Tengo una cuenta de Payoneer con una cuenta bancaria virtual de EE. UU. Me pregunto si puedo usar Stripe con ella. Dado que estoy en Argentina, me pregunto si mi cuenta de Stripe permitirá las transferencias. Gracias por la ayuda.

Julian

He estado usando Selz hasta ahora que dejaron de aceptar tarjetas de crédito para tiendas fuera de EE. UU. y me obligaron a usar PayPal ($4.99/mes). Estaría bien pagar eso para mantener el sitio en funcionamiento, pero no me gustó la forma en que hacen negocios en el siglo XXI (cambiando las reglas como lo hacen).

Moshiur Rahman

Para recibir mi pago de freelancer, siempre me encanta Payoneer.

Mustafa Bépari

¿Puedes recibir pagos de clientes individuales? Por ejemplo, si un cliente quisiera depositar efectivo en tu cuenta bancaria virtual de EE. UU., ¿lo recibirías en tu tarjeta Payoneer?

Bryan

Primero tienes que recibir pagos de los asociados de Payoneer y luego puedes recibir pagos de particulares.

Josh

Para Stripe, hay un formulario de pago alojado muy bueno que puedes usar. Se conecta a tu cuenta de Stripe y puedes enviar un enlace de pago a tus clientes.

Turqoisse

Thanks for a great article! It is quite hard to find strong alternatives to PayPal. I’ve been looking around for some time already, and found really contraversial opinions. But I guess this is the problem when we talk about money I’ve been using Google Wallet for some time for my personal online payments, But when choosing the online payment tool for my small family business I did not want to jump from one big corporation to another. My advice would be to go into details of specific region and market you are selling, and get to know your customer. I am selling hand made jewelry to European markets mostly and what I’ve found is that my clients do not trust PayPal in general. i received many request of using the alternative payments which are popular there, like Skrill, Paysera or Payza. Apparently they are really popular and appreciated for the small benefits they provide. So, I would say there is no general rule, everybody is different and every specific business needs different online payment solutions.

I’ve been using Google Wallet for some time for my personal online payments, But when choosing the online payment tool for my small family business I did not want to jump from one big corporation to another. My advice would be to go into details of specific region and market you are selling, and get to know your customer. I am selling hand made jewelry to European markets mostly and what I’ve found is that my clients do not trust PayPal in general. i received many request of using the alternative payments which are popular there, like Skrill, Paysera or Payza. Apparently they are really popular and appreciated for the small benefits they provide. So, I would say there is no general rule, everybody is different and every specific business needs different online payment solutions.

Snorre

¿Cuál sería la mejor pasarela de pago que acepte tarjetas de débito/crédito para sitios en servidores en Europa? Venta de servicio en línea a nivel mundial. Solo un producto, un precio.

Selva Prabhakaran

¿Está Selz disponible en India?

mimi

Selz requiere una dirección de PayPal a menos que vivas en Australia.

Erika Madden

Ahora tienen depósito directo en tu cuenta bancaria.

Temi Grand

¿Selz tiene enlace de depósito en África? ¿Particularmente en Nigeria?

Ifham khan

Using Gumroad from last one year and I must say, its the best

Val

Por el contrario, tuve una experiencia terrible con Gumroad. El servicio solo es útil si vendes productos digitales (los freelancers que brindan servicios en línea no están permitidos), no te importa un soporte al cliente vago o términos de servicio dudosos, y no te importa esperar 14 días para recibir el pago. Por esas razones, definitivamente NO recomendaría Gumroad.

Anirban Pathak

Gran publicación. Para mi cuenta con ellos, solo permiten pagos de redes publicitarias y empresas establecidas. Además, sus tarifas son más que altas, son extorsivas.

Maketta

Hola Jawad,

Esa fue una lista muy completa. Siempre es bueno tener más de una opción. ¡Gracias por compartir esto con nosotros!

Enstine Muki

¿Es Payoneer un procesador de pagos? ¿Puedes integrarlo en tu sitio web y cobrar pagos de clientes?

SAM

no puedes, pero esta empresa se promociona como si ofreciera ese servicio, y sitios web como este (perdón que lo diga) simplemente copian y pegan lo que dice Payoneer sin investigar más al respecto.

Payoneer no es un procesador de pagos, no puedes integrarlo en tu sitio web, no puedes recibir dinero por la venta de productos o servicios. Solo puedes recibir depósitos directos de ciertos países, a solo ciertos países, a solo una lista específica de productos/servicios permitidos (buena suerte tratando de encontrar esa lista), y si logras hacer todo eso al final, ellos pueden hacer lo que quieran con tu dinero, no tienes derecho a reclamar. Aléjate de Payoneer, de verdad. Busca su foro de usuarios en Google.

Naveen

PayPal es uno de los principales mediadores para enviar y recibir dinero en todo el mundo, y sus comisiones y tipo de cambio son bastante malos, ya que es la única opción para recibir dinero en algunos países debido a algunas restricciones.

Las otras opciones como Google Wallet y Payoneer parecen ser buenas alternativas.

Gracias.

shubham

No me gusta paypal porque necesita tarjeta PAN para registrarse con ellos (quizás para indios) :/

Payza también es una buena alternativa.

ravi

Hola,,,

tengo un sitio web de wordpress…

y en este sitio, necesito configurar el pago con payza para la membresía..

¿tienes alguna idea de cómo puedo hacer eso..?

Anurag Dhatrak

Oye, por cierto... Google Wallet no se puede usar en India... si fuera posible, sería increíble

Jamie Bull

No olvides BitPay.

Soporte de WPBeginner

No, no lo hicimos, aquí te mostramos cómo agregar un botón de Bitcoin en WordPress usando BitPay

Administrador

Dave Clements

¡¡¡+500 por Stripe!!!

jeremy

Payoneer apesta si no estás en EE. UU. Son extremadamente estrictos con la forma en que agregas fondos y la idea de que 'cualquiera' puede acreditar tu cuenta es completamente falsa.

Para mi cuenta con ellos, solo permiten pagos de redes publicitarias y empresas establecidas. Además, sus tarifas son más que altas, son extorsivas.

No puedo decir lo malos que son (fuera de EE. UU.)... quizás sean mejores en EE. UU., pero lo dudo.

ZaFr

Impresionante artículo sobre pasarelas de pago... Este es el mejor post que he encontrado sobre alternativas de pago para WordPress... Yo uso Stripe y Selz, lo mejor para mi sitio web además de Paypal

Por favor, corrija también la ortografía de "MaterCard" de Payoneer.

Gracias,

ZaFr

TheBigK

Todos son servicios válidos, pero me gustaría encontrar uno que tenga seguro FDIC. Me dijeron que PayPal tenía seguro FDIC y luego descubrí que la respuesta sigue siendo cuestionable.

Alberto Nunes

¡Hola!

Uno que estoy empezando a usar ahora es Gumroad: https://gumroad.com/

¡Es realmente genial!

Khaleesi

Es conocido.

Sü

¿Todavía necesitas un certificado SSL para usar Google como pasarela de pago?

Hasin Hayder

Don’t forget to checkout Gumroad Really nice one

Really nice one

David Bay

Este es un resumen bueno y conciso, estoy configurando un sitio de comercio electrónico en http://www.pressentz,com y he optado por usar tanto PayPal como Stripe, y estaba pensando en agregar Amazon Checkout.

Aaron

Deberías arreglar tu configuración de Wordfence, ¿a menos que estés bloqueando a propósito todo el tráfico del Reino Unido?